PVR and Inox Leisure have announced a merger resulting in the largest multiplex chain in India. The combined entity will be known as PVR INOX Ltd. Branding of existing screens will continue in the names of the pre-merger owners, PVR and INOX. New screens will be re-christened as PVR INOX.

This development has come about even when PVR had reportedly been in talks with the local unit of Mexican company Cinépolis for a possible merger.

Boards of the two companies approved the all-stock amalgamation of INOX with PVR on March 27, 2022. INOX promoters will hold a 16.66% stake, while those of PVR will have 10.62%, in the merged entity. Although, the merger is subject to approval by regulators, shareholders and stock exchanges, there do not seem major blockers, especially with the thrust GoI is offering the Media & Entertainment Industry.

WHAT DOES IT MEAN FOR MULTIPLEX STOCKS?

The multiplex behemoth, this merger will create, with a network of more than 1,500 screens all across India could possibly be the start of a monopolistic operator in the theatre business. As per the agreement, the share swap ratio is 3:10 i.e., 3 shares of PVR for 10 shares of Inox.

The ratio has valued INOX at 17 times EV/Ebitda and EV/screen of Rs 9 Cr. 15% higher than its current price, but 18% lower than PVR’s valuation on a FY20 basis.

A reconstituted board will have 10 members, with promoter families represented with 2 seats each. INOX’s Pavan Kumar Jain will be the non-executive chairman, while PVR’s Ajay Bijli will be the managing director and his brother Sanjeev Kumar Bijli will be the executive director.

Analysts have said the ratio is slightly favourable to INOX investors by about 12%, probably due to its zero net debt situation compared with PVR’s net debt at Rs. 857 Cr. This was visible in the 20% surge in shares of INOX compared with a 10% rise in PVR.

The merger is bound to see material revenue & cost synergies by improving bargaining power with film distributors, ad-networks, real estate developers and ticket aggregators, F&B deals.

MARKET SHARE

PVR has dominance in the north and south, INOX is more focussed on eastern and western regions, with opportunities in the length and breadth of India.

| Entity | Screens | Properties | Cities |

| PVR | 871 | 181 | 73 |

| INOX | 675 | 160 | 72 |

| Combined Total | 1546 | 341 | 109 |

| Total Screens in India including other players | 9500 |

INOX has a lower share of non-ticketing revenue at 42% against PVR’s 48%. This will allow INOX to leverage the scale of the merged entity.

THE CCI REVIEW

The CCI has the voluminous task of assessing appreciable adverse effect on competition in the market. In 2016, in PVR and DT Cinemas merger, some screens had to be divested for the deal to be cleared by CCI. It is possible a similar scenario may apply here of shedding screens in key metros such as Delhi and Mumbai.

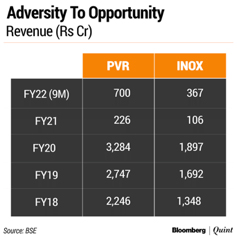

India’s merger control regulations exempt small transactions, where the merged entity has assets below INR 350 Cr or revenue below INR 1,000 Cr in the preceding financial year. The exemption has been extended for 5 years. The merger was announced on March 27, which has fostered FY 21 also the worst year for Cinema halls.

It is predicted that INOX’s total revenue in FY22 will be below INR 1,000 Cr due to Covid-19 and therefore CCI rules may not come into play, unless a suo motu action is preferred by CCI.

CONCLUSION

The pandemic that crippled the business of India’s two leading multiplex operators, with no immediate review required by India’s competition authority. It is a clever business choice also to deal with the revenue erosion OTTs seem to be doing. It is unlikely to be reviewed for appreciable adverse effect by the CCI today, but will it be charged for being a dominant player eventually? Time will tell.

This is only for informational purposes. Nothing contained herein is, purports to be, or is intended as legal advice and you should seek legal advice before you act on any information or view expressed herein. Endeavoured to accurately reflect the subject matter of this alert, without any representation or warranty, express or implied, in any manner whatsoever in connection with the contents of this. This isn’t an attempt to solicit business in any manner.

Sources: Live Mint, Economic Times, Times of India, Indian Express and Bloomberg Quint